How to Calculate Your Loan EMI: A Step-by-Step Guide

Calculating your loan EMI (Equated Monthly Installment) is a crucial step in understanding your loan repayment structure. In this blog post, we’ll walk you through a step-by-step guide on how to calculate your loan EMI.

What is EMI?

EMI stands for Equated Monthly Installment, which is the amount you need to pay every month towards your loan repayment. It includes both the principal amount and the interest component.

Formula to Calculate EMI

The formula to calculate EMI is:

EMI = [P x R x (1 + R)^N] / [(1 + R)^N – 1]

Where:

- P = Principal Amount (the loan amount borrowed)

- R = Monthly Interest Rate (annual interest rate divided by 12)

- N = Loan Tenure in Months (the number of months you have to repay the loan)

Step-by-Step Calculation

Let’s break down the calculation into steps:

- Determine the Principal Amount (P): This is the loan amount you borrow from the lender.

- Calculate the Monthly Interest Rate (R): Divide the annual interest rate by 12 to get the monthly interest rate. For example, if the annual interest rate is 12%, the monthly interest rate would be 1% (12%/12).

- Determine the Loan Tenure in Months (N): This is the number of months you have to repay the loan.

- Plug in the values: Enter the values of P, R, and N into the EMI formula.

- Calculate the EMI: Use a calculator or an online EMI calculator tool to calculate the EMI.

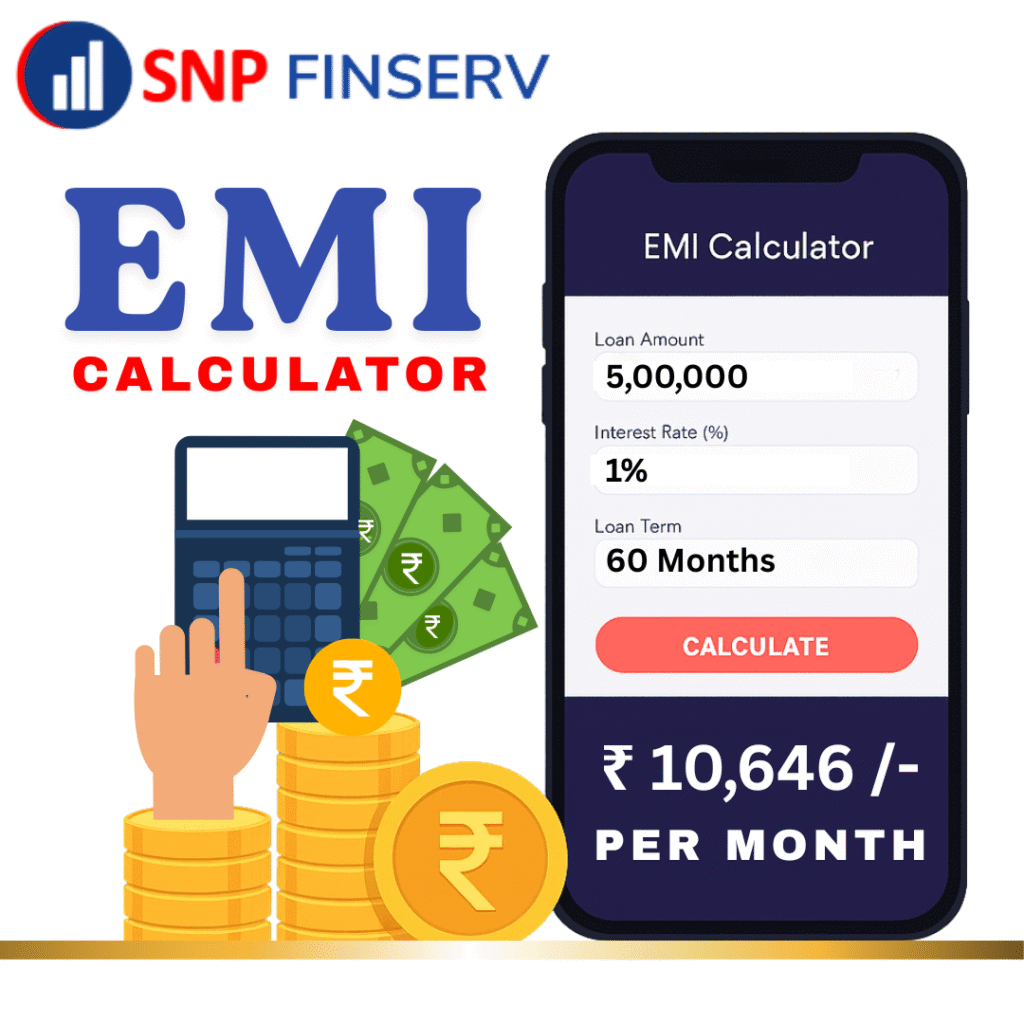

Example Calculation

Let’s say you borrow a loan of ₹ 5,00,000 (Principal Amount) for 5 years (60 months) at an annual interest rate of 12% (1% monthly interest rate).

- P = ₹ 5,00,000

- R = 1% (12%/12)

- N = 60 months

Using the formula, we get:

EMI = [5,00,000 x 0.01 x (1 + 0.01)^60] / [(1 + 0.01)^60 – 1]

EMI ≈ ₹ 10,646

Benefits of Calculating EMI

Calculating your loan EMI helps you:

- Understand your loan repayment structure

- Plan your finances accordingly

- Make informed decisions about your loan

- Avoid any surprises or shocks during the loan repayment period

By following these steps, you can calculate your loan EMI and take control of your loan repayment. Remember to consider other costs associated with the loan, such as processing fees and prepayment charges, to get a complete picture of your loan expenses.