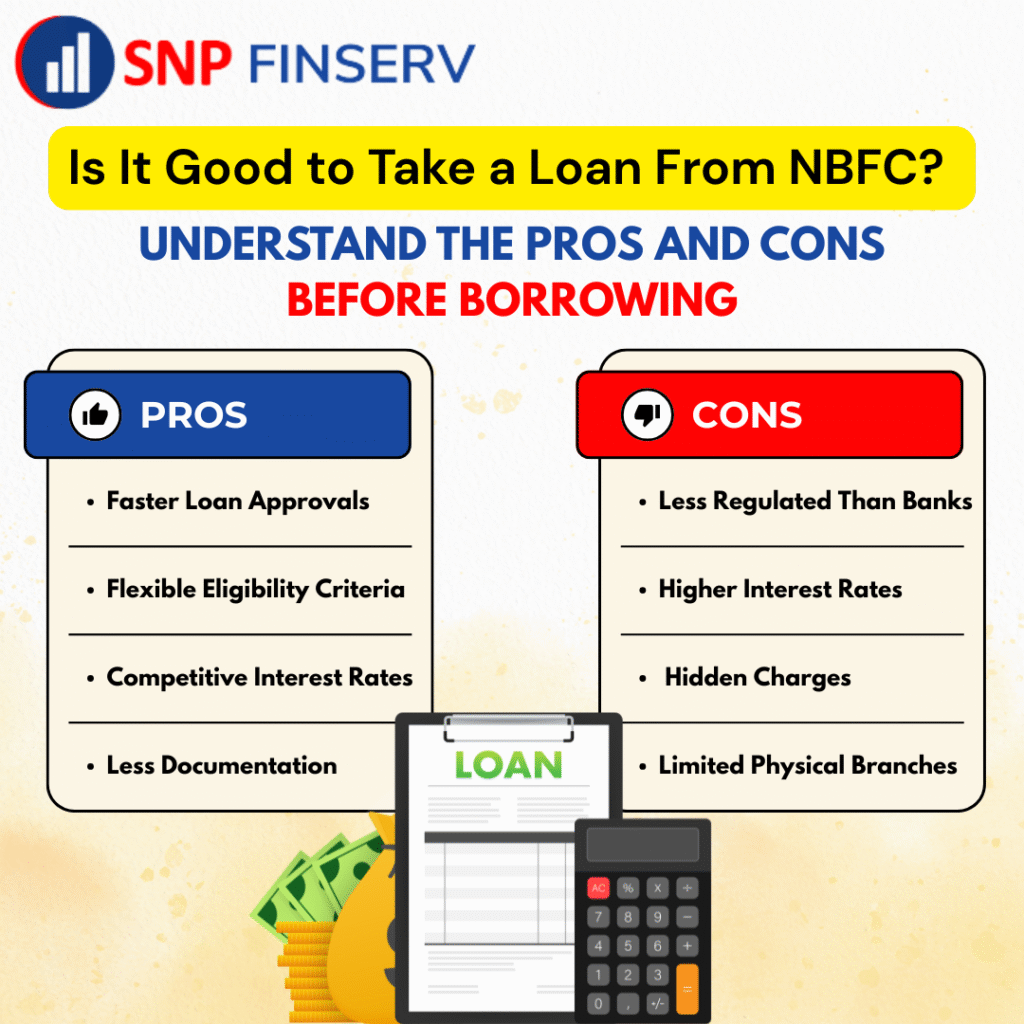

Is It Good To Take A Loan From NBFC? Understand The Pros and Cons Before Borrowing

In today’s fast-paced financial world, Non-Banking Financial Companies (NBFCs) have emerged as a popular alternative to traditional banks for availing loans in India. Whether it’s a personal loan, business loan, or vehicle loan, NBFCs have carved a significant space in the lending ecosystem.

But before you decide to borrow, it’s important to understand the advantages and disadvantages of taking a loan from an NBFC.

✅ What is an NBFC?

An NBFC (Non-Banking Financial Company) is a financial institution that provides banking services like loans, asset financing, investment, and more — without having a full banking license. NBFCs in India are regulated by the Reserve Bank of India (RBI) and must adhere to certain guidelines to ensure borrower safety.

✅ Pros of Taking a Loan from an NBFC

- Faster Loan Approvals

NBFCs are known for their quick loan processing and disbursal. Unlike banks that may take several days or even weeks, NBFCs can approve and release funds within 24–72 hours for eligible borrowers - Flexible Eligibility Criteria

NBFCs offer loans to individuals who might not qualify for traditional bank loans due to low credit scores, irregular income, or a lack of formal income proof. - Competitive Interest Rates (for some segments)

While NBFC interest rates may vary, some leading NBFCs offer attractive rates for personal and business loans, especially for salaried professionals and creditworthy customers. - Wide Range of Loan Products

NBFCs offer a variety of loans:

• Personal Loans

• Business Loans

• Education Loans

• Vehicle Loans

• Home Loans

• Consumer Durable Loans - Less Documentation

Borrowers appreciate the minimal paperwork required by NBFCs. Many even offer fully digital loan application processes, saving time and hassle.

❌ Cons of Taking a Loan from an NBFC

- Higher Interest Rates (for risky borrowers)

NBFCs may charge higher interest rates compared to banks, especially for borrowers with low credit scores or unstable income - Less Regulated Than Banks

Though regulated by the RBI, NBFCs don’t follow the same strict norms as banks. This could lead to variations in service quality, transparency, and grievance redressal. - Hidden Charges

Some NBFCs may apply processing fees, prepayment penalties, or insurance bundling that are not clearly disclosed upfront. Always read the fine print before signing. - Limited Physical Branches

Unlike banks, many NBFCs are online-first or operate in limited regions. This can be a concern for borrowers who prefer face-to-face assistance.

📝 When Should You Choose an NBFC Over a Bank?

• When you need quick loan approval

• If you have a low CIBIL score or irregular income

• When traditional banks have rejected your application

• If you want to try a fully digital loan experience

📌 Tips Before Taking a Loan from an NBFC

Choose trusted and RBI-registered NBFCs

Compare interest rates with banks and other NBFCs

Check for hidden charges and processing fees

Verify NBFC registration on the RBI’s official website

Read the loan agreement carefully before signing

🔚 Final Verdict: Is It Good to Take a Loan from an NBFC?

Yes, taking a loan from an NBFC can be a smart choice if you need quick funds, face difficulty meeting bank criteria, or want a more flexible lending experience. However, always ensure that the NBFC is reputed, transparent, and RBI-registered.