Submit Enquiry for One Person Company Registration

One Person Company Registration

Get your OPC Registered

in just 7-10 days at Rs.999/- only.

Complete OPC setup in 7–10 working days

End-to-end support: name approval, MOA/AOA, PAN & TAN

Quick delivery of Incorporation Certificate, DIN & DSC

Trusted by over 20,000 entrepreneurs

MCA-certified professionals

Company Registration In 4 Easy Steps

Objectives of Registering a One Person Company (OPC)

Registering an OPC can help solo entrepreneurs achieve these objectives and support business growth.

1. Limited Liability Protection: Protect personal assets from business risks.

2. Separate Legal Entity: OPC is a separate entity from its owner, providing credibility.

3. Tax Benefits: Avail tax benefits and deductions.

4. Perpetual Existence: OPC continues to exist despite changes in ownership.

5. Professional Image: Enhance business reputation and credibility.

6. Easy Compliance: Simplified compliance requirements compared to other company structures.

7. Flexibility: OPC offers flexibility in management and operations.

Registering an OPC can help solo entrepreneurs achieve these objectives and support business growth.

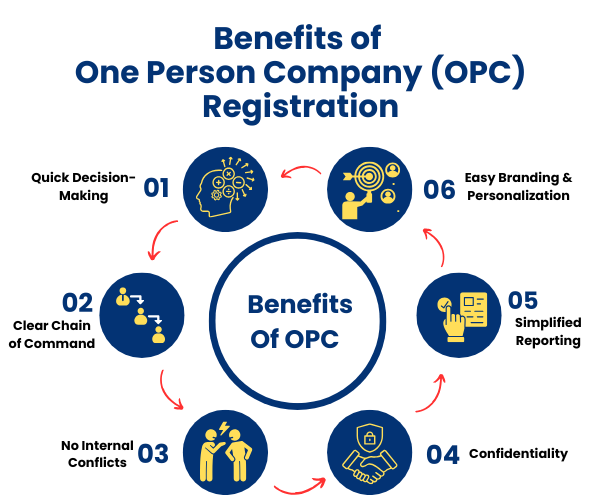

Benefits of One Person Company (OPC) Registration

- 1. Limited Liability Protection: Protects personal assets from business risks.

2. Separate Legal Entity: Enhances credibility and reputation.

3. Tax Benefits: Avail tax benefits and deductions.

4. Perpetual Existence: OPC continues to exist despite changes in ownership.

5. Professional Image: Projects a professional image, boosting business reputation.

6. Easy Compliance: Simplified compliance requirements compared to other company structures.

7. Flexibility: OPC offers flexibility in management and operations.

8. Credibility with Banks and Financial Institutions: Easier access to loans and credit.

9. Ability to Raise Funds: Can raise funds from investors and venture capitalists.

Do I need to be physically present during this process?

No, new company registration is a fully online process. As all documents are filed electronically, you would not need to be physically present at all. You would need to send us scanned copies of all the required documents & forms.

What documents are required to complete the process?

For the Registered Office:

Proof you own the place or a rental agreement

No-objection letter from the property owner (for rented spaces)

Recent utility bills show the addressThe documents required for One Person Company registration include identity proof, address proof, and registered office proof, among others, which are as follows:

For the Member/Director:

PAN Card and Aadhaar Card for identity verification

Recent passport-sized photographs for official records

Government-issued ID (Passport, Driving License, or Voter ID)

Proof of where you live (Recent utility bills, bank statements)

Digital Signature Certificate (DSC) for signing documents electronically

For the Registered Office:

- Proof you own the place or a rental agreement

- No-objection letter from the property owner (for rented spaces)

- Recent utility bills show the address

Additional Requirements:

Director Identification Number (DIN) obtained during registration

Declaration of your planned business activities

How many OPCs can one person form?

An individual can be a member of only one OPC company through One Person Company Registration at any given time. This restriction prevents the misuse of the One Person Company Registration structure for creating multiple limited liability entities.

Who is eligible to be a member of an OPC?

An individual who is a natural person, an Indian citizen, and a resident in India is eligible to incorporate an OPC. The person must not be a member or nominee of more than one OPC at a time. Foreign nationals, companies, and LLPs are not permitted to form or join an OPC.

What is the difference between an OPC and a sole proprietorship?

One Person Company Registration provides limited liability protection, creating a clear separation between personal and business assets, while a sole proprietorship offers no such distinction.

What to keep in mind while Registering a

One Person Company ?

Key Considerations for One Person Company (OPC) Registration

1. Eligibility: Ensure you’re an Indian citizen and resident.

2. Name Selection: Choose a unique name that complies with MCA guidelines.

3. Director and Shareholder: One person can be both director and shareholder.

4. Nominee Requirement: Appoint a nominee who will take over in case of incapacitation or death.

5. Registered Office: Maintain a registered office address in India.

6. Compliance Requirements: Understand annual filing and other compliance requirements.

7. Tax Implications: Consider tax implications and benefits.

8. Documentation: Ensure accurate and complete documentation.

9. Professional Guidance: Consider consulting a professional for guidance.