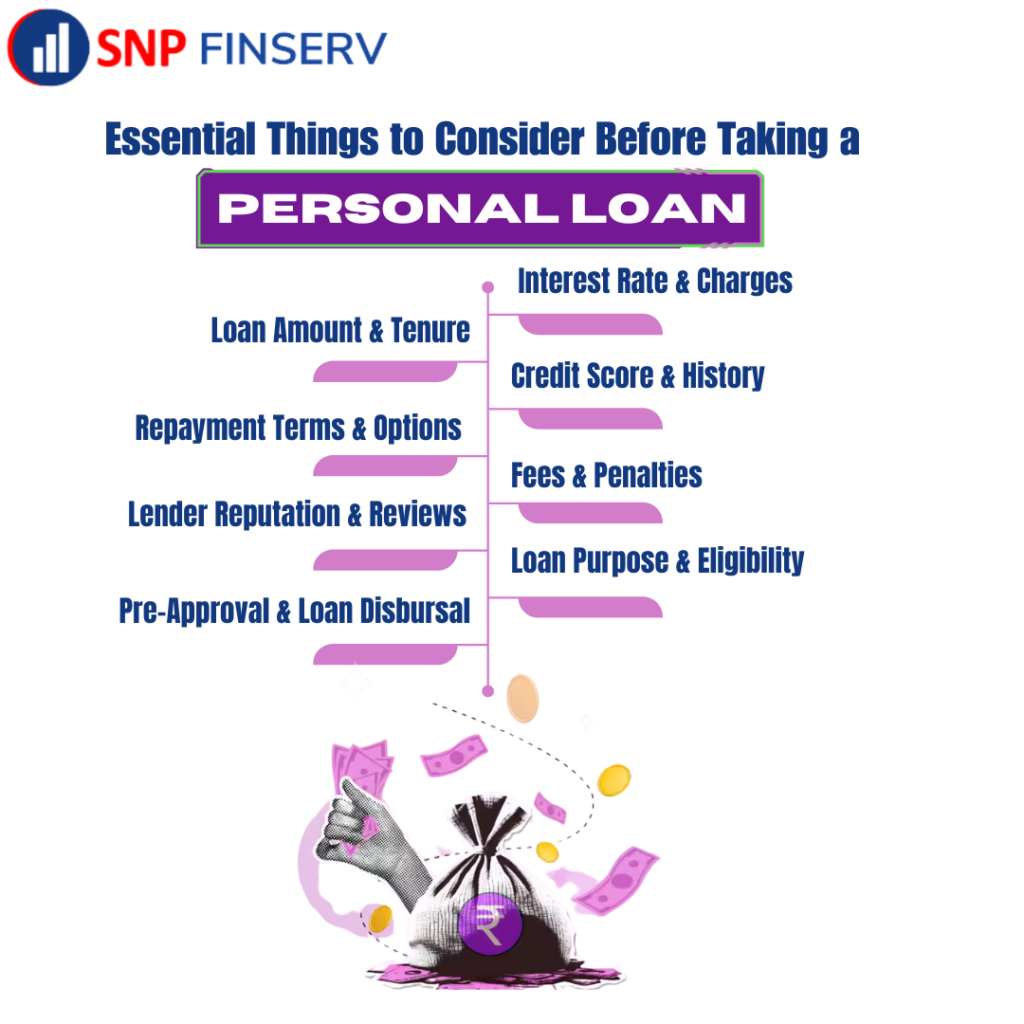

1. Interest Rate and Charges

Understand the interest rate, processing fees, and other charges associated with the loan. Compare rates from different lenders to ensure you’re getting the best deal.

2. Loan Amount and Tenure

Determine how much you need to borrow and for how long. A longer tenure may reduce your monthly payments, but you’ll pay more in interest over the life of the loan.

3. Credit Score and History

Check your credit score and history to ensure you’re eligible for the loan. A good credit score can help you qualify for lower interest rates.

4. Repayment Terms and Options

Understand the repayment terms, including the monthly payment amount, due date, and late payment fees. Check if the lender offers flexible repayment options, such as part-prepayment or foreclosure.

5. Fees and Penalties

In addition to interest rates, consider other fees and penalties, such as:

– Processing fees

– Late payment fees

– Part-prepayment or foreclosure charges

– Cheque bounce charges

6. Lender Reputation and Reviews

Research the lender’s reputation, reading reviews from other customers to ensure they’re reliable and trustworthy.

7. Loan Purpose and Eligibility

Verify that the loan is for a legitimate purpose, such as debt consolidation, wedding expenses, or medical emergencies. Ensure you meet the lender’s eligibility criteria, including age, income, and employment requirements.

8. Pre-Approval and Loan Disbursal

Understand the pre-approval process and loan disbursal timeline. Ensure you receive the loan amount within a reasonable timeframe.